Cyber Insurance Costs and What It Means for Your Risk Strategy

Sep 02, 2025

A cyber incident can shut down operations, drain revenue, and shake customer trust in a matter of hours.

In 2025, small businesses can expect to pay an average of between $120,000 and $1.24 million to respond to and recover from a data breach, depending on the severity and industry. That’s before factoring in the long-term loss of contracts or market credibility.

For many leaders, understanding the cost of cyber insurance and its importance is now a core part of staying in business.

Danny Tehrani, CEO at Computers Made Easy, says, “Cyber insurance is no longer about covering losses after a cyber attack event. It’s about proving to yourself, your customers, and your investors that you can take a hit and keep moving.”

In this guide, you’ll learn the current 2025 cost ranges, what drives those numbers, and how to align your coverage with a smarter, more resilient risk strategy.

Lower Your Cyber Insurance Cost With Proven IT Expertise!

Partner with Computer Made Easy to strengthen your security posture and reduce insurance premiums.

Learn MoreHow Much Does Cyber Insurance Cost in 2025

The cyber insurance cost in 2025 varies greatly based on the size of your business, the type of data you handle, your industry, and your past cybersecurity record. Yet, despite the growing risks, only 17% of small businesses currently carry cyber insurance, compared to 84% of larger organizations.

For small businesses, the cost can range from a few hundred dollars per year to several thousand. Larger organizations with high-value or sensitive data can expect to pay tens of thousands annually.

Prices have increased steadily over the last few years due to the rising frequency and complexity of cyberattacks, as well as the growing expenses insurance companies face when handling claims.

When people search for the cost of cyber insurance, they often expect a fixed number. In reality, it works more like car insurance; your premium is based on your unique risk profile. Insurers evaluate your security measures, your claim history, and the level of coverage you choose.

Businesses in industries such as healthcare, finance, and e-commerce often pay more because of the sensitive nature of the information they store.

Here’s a closer look at average costs in 2025:

- Small businesses: Typically $600 to $2,500 per year. If you store sensitive client or payment data, expect to be on the higher end.

- Mid-sized companies: Around $5,000 to $15,000 annually. The price depends heavily on the number of employees, the amount of data handled, and your industry.

- Large enterprises: $25,000 to $50,000 or more each year. Global operations or high compliance requirements can push this even higher.

These figures are only averages. If your business operates in a high-risk industry or has a history of cyber incidents, your premium could exceed these ranges. On the other hand, if you have strong cybersecurity measures, incident response plans, and regular employee training, insurers may offer lower rates.

The most important step is to get quotes from multiple providers and compare coverage side by side.

Factors that Influence Cyber Insurance Pricing

The amount you pay for cyber insurance in 2025 depends on a mix of internal and external factors. Insurers don’t use one flat rate. Instead, they assess the level of risk your business presents before offering a premium.

Understanding these factors helps you see why two similarly sized companies might pay very different rates. Key factors that affect pricing include:

Business Size and Annual Revenue

Larger businesses have more data, more employees, and more digital systems. This means a bigger “attack surface” for cybercriminals. Insurers may see them as higher risk and charge more.

Industry and Type of Data Handled

Industries such as healthcare, finance, and e-commerce stores handle highly sensitive personal or financial information. These sectors face stricter data protection rules, and a cyberattack can have costly legal and regulatory consequences. This increases insurance premiums.

Cybersecurity Measures in Place

If you use firewalls, encryption, multi-factor authentication, and regular security audits, insurers see you as less risky. Strong cybersecurity practices can lead to significant discounts. Weak or outdated systems will have the opposite effect.

History of Cyber Incidents

If you’ve had previous cyber incidents or insurance claims, insurers may see you as more likely to have future issues. This can raise your premium, sometimes significantly.

Coverage Limits and Policy Features

Higher coverage limits and additional features, such as business interruption coverage or ransomware payment coverage, cost more. Choosing a lower deductible can also raise your premium.

Regulatory Compliance

Businesses that comply with standards such as ISO 27001, SOC 2, HIPAA, or PCI-DSS often qualify for more favorable rates, as they demonstrate robust data protection practices. This is also where compliance budgets are expanding.

66% of companies say that compliance mandates are driving their security spending. For insurers, this investment signals a proactive approach to risk management, which can translate into lower premiums.

Trends Shaping Cyber Insurance Costs in 2025

A company’s size, industry, or security setup aren’t the only factors influencing cyber insurance costs in 2025. Broader market trends and global events also significantly affect how premiums are calculated. These trends help explain why prices have been rising in recent years and what might happen going forward. Major trends influencing pricing include:

Increase in Ransomware Activity

Ransomware attacks remain one of the most expensive cyber incidents for businesses. Criminal groups continue to target companies of all sizes, often demanding payments in cryptocurrency. Even when companies refuse to pay, the costs of recovery, lost business time, and potential legal issues make insurers factor in higher risk.

1 in 5 small businesses have been forced to shut down entirely after losing critical data to ransomware, a stark reminder that the financial impact can extend far beyond the ransom itself.

Stronger Regulatory Requirements

Governments and industry bodies are introducing stricter rules around data protection. Laws such as GDPR in Europe, CCPA in California, and other regional privacy laws mean that a single incident can lead to heavy fines. Insurers must consider these potential costs when setting premiums.

Supply Chain Vulnerabilities

Many cyber incidents now occur through third-party vendors or service providers. If your business relies on cloud services, software providers, or other partners, their security practices can impact your risk level. This has led insurers to raise premiums or request proof of vendor risk management.

Use of Advanced AI by Cybercriminals

Cybercriminals are using AI tools to create more convincing phishing emails, scan for vulnerabilities faster, and automate attacks. This makes defending against threats harder, which increases the potential payout for insurers.

Higher Demand for Coverage

As more businesses understand the financial risks of cyber incidents, demand for cyber insurance has grown. This demand, combined with the higher cost of claims, puts upward pressure on prices.

While these trends are driving costs up, businesses can manage the impact by improving cybersecurity, training employees, and working with insurers that offer risk assessment and prevention services.

| More articles you might like: 7 Risks of BYOD & How to Avoid Them Why Cloud Security Assessments Are Important & How to Perform One Data Migration from Legacy Systems: A Step-by-Step Strategy |

How to Manage and Reduce Cyber Insurance Costs

Cyber insurance is becoming more expensive each year, but there are practical ways to lower your premiums without compromising the level of protection.

Insurers set prices based on risk. If you can prove your business has strong security measures in place, you are more likely to qualify for lower rates. The key is to address both technical and operational risks so that your company looks less risky to cover.

Effective ways to reduce your cyber insurance cost include:

- Strengthen cybersecurity: Use firewalls, antivirus, MFA, and adopt standards like ISO 27001 or NIST to show you’re low-risk.

- Train staff regularly: Educate employees on phishing, passwords, and security habits. Insurers may offer discounts for this.

- Have a response plan: Maintain backups, test recovery processes, and set clear protocols to limit damage from incidents.

- Vet your vendors: Ensure third-party partners meet security standards and include cyber clauses in contracts.

- Review policies annually: Update coverage and security practices as your business evolves to stay compliant and cost-efficient.

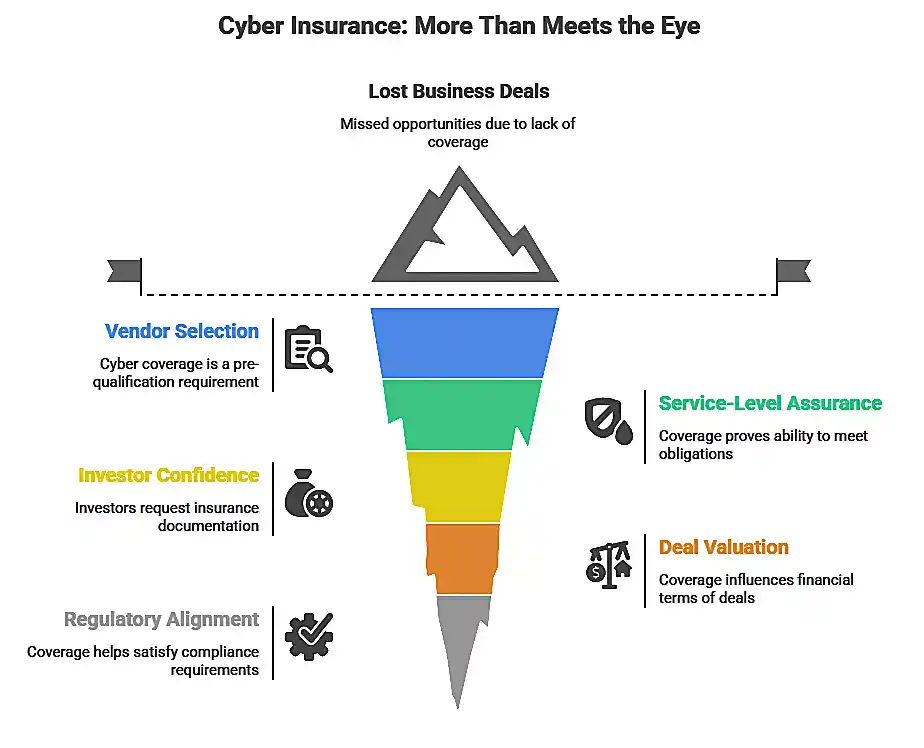

How Cyber Insurance Influences Client Trust and Business Deals

Cyber insurance is more than a safety net. It directly affects how partners, clients, and investors perceive your business.

Large enterprises and regulated industries now expect proof of adequate coverage before signing contracts. Without it, you may lose opportunities without ever reaching the negotiation stage.

For managed service providers, this expectation carries extra weight. Clients need assurance that if a security incident occurs, you have both the operational capacity and financial backing to recover.

Key ways cyber insurance impacts trust and business opportunities:

- Vendor Selection: Many corporate procurement teams now make cyber coverage a mandatory pre-qualification requirement.

- Service-Level Assurance: Clients view coverage as proof that you can meet contractual obligations even under adverse conditions.

- Investor Confidence: Investors and lenders often request insurance documentation during due diligence.

- Deal Valuation: Coverage limits and exclusions can influence the financial terms of mergers, acquisitions, or partnerships.

- Regulatory Alignment: Demonstrating coverage can help satisfy sector-specific compliance requirements and audits.

In practice, your cyber insurance strategy is no longer just about limiting financial risk. It has become a competitive advantage.

Aligning your coverage with operational needs and market expectations can help you secure contracts, negotiate better terms, and position your business as a trusted partner.

Sample Cyber Insurance Premium Scenarios

Pricing for cyber insurance varies widely depending on company size, coverage limits, and industry.

While earlier sections covered average ranges, the table below provides practical examples based on real-world underwriting patterns in 2025. This helps business leaders quickly benchmark their current position and determine whether they are paying within a fair range for their risk profile.

| Company Size | Coverage Limit | Industry Example | Annual Premium (USD) | Key Pricing Factor |

| Small (10–50 staff) | $250,000 | Retail | $2,800 – $4,200 | Low claims history, minimal compliance needs |

| Small (10–50 staff) | $1 million | Healthcare | $8,500 – $12,000 | HIPAA compliance requirements increase the cost |

| Mid-size (51–200 staff) | $1 million | Professional Services | $6,800 – $9,500 | Moderate claims risk, need for rapid response support |

| Mid-size (51–200 staff) | $3 million | Manufacturing | $14,000 – $18,500 | Critical operational continuity requirements |

| Large (200+ staff) | $5 million | Finance | $45,000 – $62,000 | High regulatory oversight, extensive client data exposure |

These examples demonstrate that two businesses of similar size can have significantly different premiums based on compliance requirements, data sensitivity, and industry risk profiles.

Lower Your Cyber Insurance Costs with Computer Made Easy’s Proven IT Strategy

Understanding cyber insurance costs is a strategic requirement for protecting your business and meeting compliance needs. The right coverage works best when paired with proactive IT management from a trusted provider.

Computer Made Easy delivers that trust. With 27+ years in business and support for more than 10,000 users nationwide, we keep your systems secure, efficient, and resilient. Our team ensures strong cybersecurity practices, minimizing the risks that could increase your premiums.

Contact us today to schedule a consultation and see how Computer Made Easy can help you maximize your security posture and control your cyber insurance cost.